Business

5 Tips for Starting a Limited Liability Company

If you are thinking of starting up a business, one of the decisions you have to make is deciding which structure you need. Generally, you can choose to operate your business as an LLC, partnership, sole proprietorship, etc. For many, however, becoming an LLC is their go-to option.

A Limited Liability Company (LLC) is a licensed United States company under which the owners are not personally liable for the company’s debts and liabilities. The beauty about LLCs is that they enjoy the tax pass-through of sole proprietorships or partnerships while also maintaining the limited liability of a corporation.

Tips for starting an LLC

- Hire professionals to help you out with some tasks: If you want things to move quicker and smoother, you shouldn’t do everything yourself. You may need to hire a part-time accountant and a lawyer to help you with the quarterly accounting and legal aspects of starting a business.

- Get advice from a taxation expert to avoid making fundamental mistakes that may later lead you to pay excessive amounts of taxes. Being diligent about reporting both income and expenses assures that you won’t have to pay for more things than you actually need to.

- Make sure all the shareholders and other company stakeholders are aware of their responsibilities and benefits.

- Have a clear business plan and a substantial budget for executing it. A business plan may not perfectly predict the future, but it will give your business a sense of direction.

- The location you choose matters, so ensure to consider all factors before deciding the location of your business.

For tax purposes, one may prefer an s-corp structure. s-corp is technically not a business structure like a c-corp or an LLC, it is simply a tax status. To get the s-corp tax status, you need to first register as an LLC or c-corp and then send Form 2553 to the IRS and request your business to be taxed accordingly. Under an s-corp, you can potentially save money by paying employees in distributions and salaries (distributions are only taxed on income, whereas salaries face income and employment tax). This means that s-corps can pay a significant amount of their revenues through distributions, allowing them to save money on taxes.

S-corps, however, do have caveats. They can’t have over 100 members in the company, and all of them must be U.S citizens.

On the other hand, a c-corp is the type of business structure in the USA where owners or shareholders are taxed separately from the entity. C-corps profits are taxed at the income tax rate, which is usually more favorable. However, both c-corps and LLC owners have limited liability, so they are not personally liable for the business debts and liabilities.

So, what is limited liability? Articles usually mention it as a benefit to incorporating as an LLC, but many of them don’t actually tell you what it means. Having limited liability tied to your company protects your personal assets in a court of law, meaning that your company would be the entity that takes on any presented legal burden. If sued, you won’t have to give up any of your individual belongings to cover a debt.

Having a Limited Liability Company provides many benefits. Protection, credibility, and organization are among the most important!

Business

Bitcoin Hits An All-Time High Above $66,000

Bitcoin reached its all-time high earlier this week, hitting the $66,000 mark last Wednesday– the highest price we’ve seen the cryptocurrency achieve since April.

Bitcoin has been gaining value since the beginning of this month. On October 1st, the price of Bitcoin was $48,159; the current value represents a 37% increase in just three weeks. However, it’s not the first time we have seen such a sharp increase in Bitcoin’s price. We already saw a staggering 50% increase between March and April.

However, for those planning to buy Bitcoin at the current high price, it may not always be a good idea–at least according to expert Anjali Jariwala. “Usually, when an investment hits an all-time high, that is the least ideal time to buy,” Jariwala, certified financial planner, public accountant, and founder of Fit Advisors told CNBC in an interview. She further said it makes more sense to wait for prices to drop before you can buy Bitcoin.

Buying is always ideal when the prices go down. Although we don’t know when this will be, Bitcoin may drop soon when you consider the trends of this cryptocurrency. There is also a possibility of the price going even higher than what we saw on Wednesday if demand happens to continue skyrocketing as it has been in the last couple of weeks.

Bitcoin and other cryptocurrencies are historically volatile, so their prices will always see a huge change now and then, mainly depending on how much demand they get on the different crypto exchange platforms. The price also relies heavily on speculation. Recently, we saw the prices of Bitcoin skyrocket when Elon Musk tweeted about Tesla adding Bitcoin as one of the accepted payment methods on their website.

For people trying to buy Bitcoin with long term intentions, Ivory Johnson, certified financial planner, chartered financial consultant, and founder of Delancey Wealth Management, argues that buying Bitcoin now would not be a horrible idea because as more people continue to adopt this cryptocurrency, its prices will simply to go up.

The idea is Bitcoin will reach a point when its supply is fixed, and its prices will only be going up as more people continue to adopt it. Thus, a $10,000 price difference will likely not have a significant impact in 5 or 10 years from today.

Business

5 Tips To Become A Successful Entrepreneur

One of the reasons why many people want to be entrepreneurs is to get financial freedom and the freedom of not having to answer to a boss. This article has compiled 5 tips that you can use in your pursuit of that lifestyle.

What is an entrepreneur?

Let’s first define who an entrepreneur is. An entrepreneur is simply someone who sets up a business to solve a particular problem in society, bearing most of the risks and enjoying most rewards.

Tip #1: Have a vision

One of the main catalysts of discipline and commitment is having a clear vision. When you know where you are going and what you want to achieve, it is easier to put in the work and dedication every day.

Tip #2: Challenge yourself

If you want to be in your comfort zone, then entrepreneurship is not for you. To become a successful entrepreneur, you have to be ready to do the uncomfortable stuff many people run away from.

Tip #3: Have a passion for your work

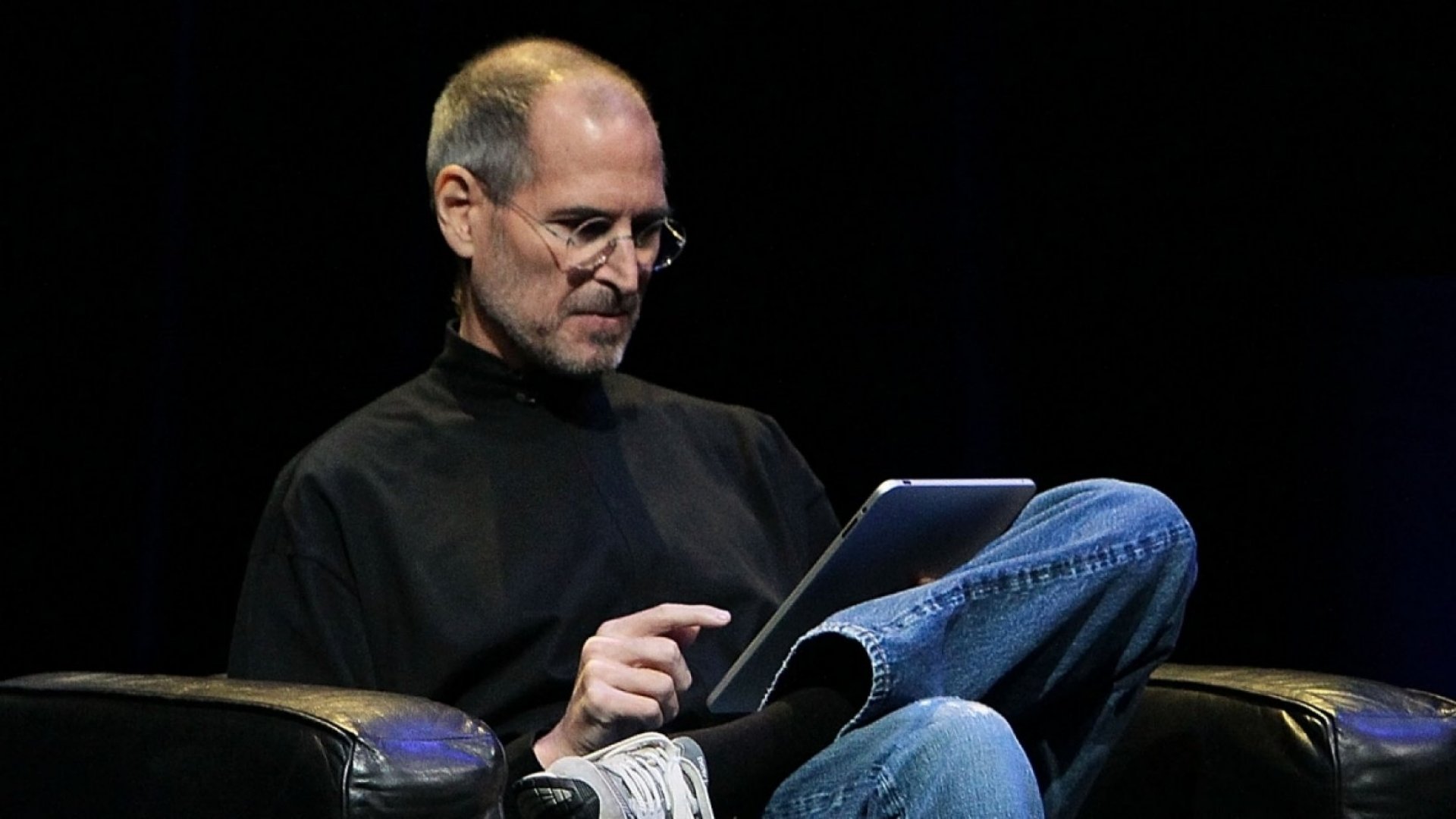

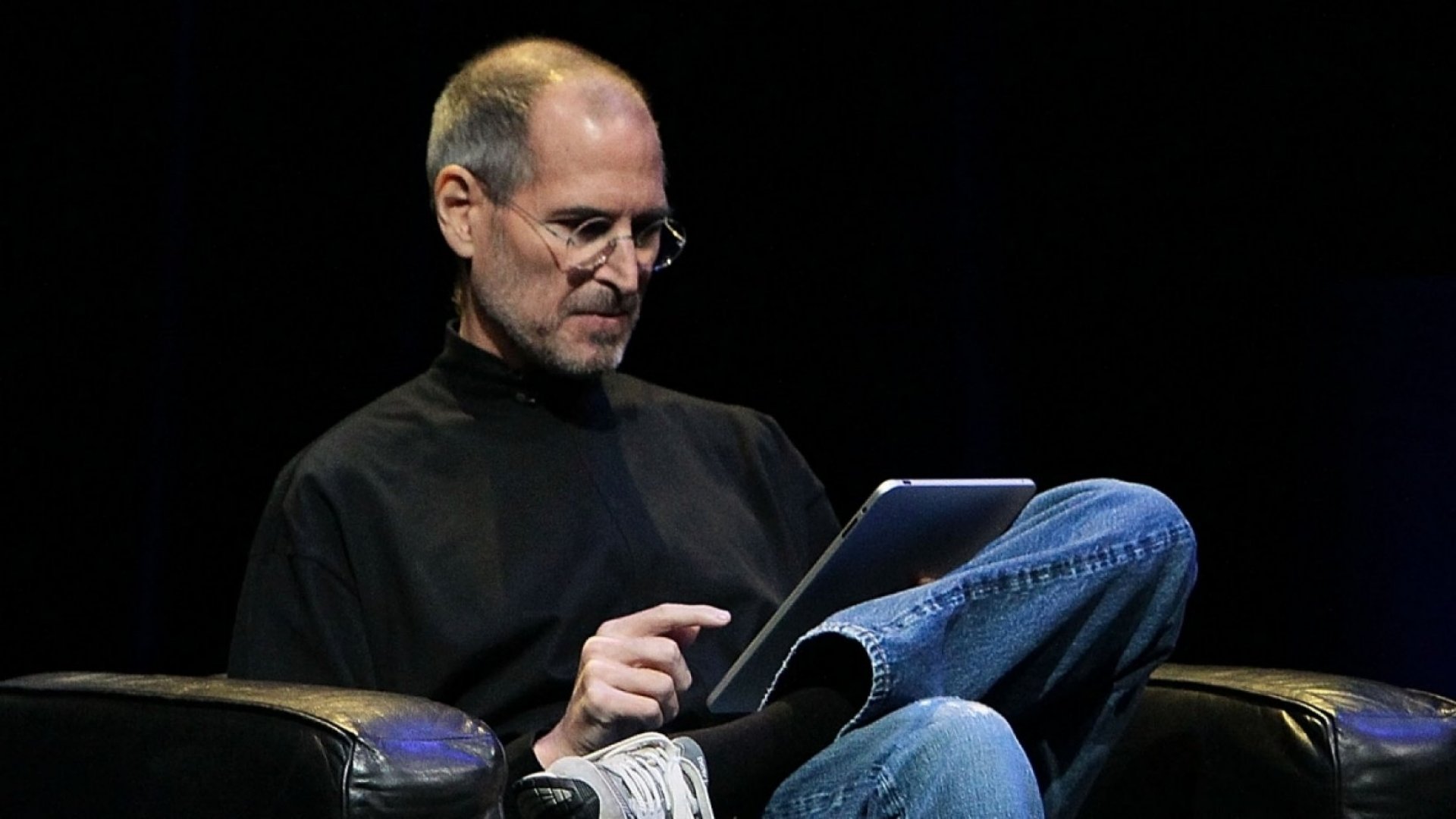

Getting up early every day and trying to do the uncomfortable requires a lot more than just having the discipline; you need to have passion for the work you do. In one of his famous quotes, Steve Jobs once said, “the only way to do great work is to love what you do.”

Tip #4: Have a great team around you

It is almost impossible to become a successful entrepreneur by doing it alone. One way you can focus on building a strategic direction for your idea and business is by delegating some of the tasks that consume most of your time. Building great partnerships and hiring the best talent are some of the first things you have to do.

Tip #5: Take calculated risks

Entrepreneurship is about taking risks and working on ideas whose success is not guaranteed. However, it is essential to take risks that won’t bring you back to anything. Always have a backup plan whenever you are investing time and money into a highly risky business idea.

Business

An Overview of Steve Jobs’ Journey to Success

Despite his lack of passion for formal education, Steve Jobs developed a love for engineering.

When Steve Jobs studied at Homestead High School, Bill Fernandez introduced him to Steve Wozniak, and they became good friends. However, he increasingly became rebellious at school, leading him to drop out. Before dropping out, he had enrolled in an electronics class due to his passion for engineering.

The birth of Apple and his next ventures

After years had passed, Steve Jobs and Steve Wozniak remained friends. When Steve Wozniak designed a low-cost digital “blue box” device, Steve Jobs sold it. He then split the profits with Steve Wozniak. It is said that the successful sales of the Blu Box could have inspired Steve Jobs to consider pursuing electronics for fun and profit.

By 1976, Steve Wozniak had designed the Apple 1 computer, which he then showed Steve Jobs. They sold the computer and then formed the Apple Computer Company in Steve Job’s parents’ garage.

As the company grew, his net worth also grew. The company invested in making other products like the Macintosh in 1981. Macintosh became a sales hit, but its demand declined because of poor performance issues.

Earlier, Steve Jobs had hired John Sculley to serve as Apple’s CEO. Over time, Steve Jobs and John Sculley started to disagree on the best way to design computers. John Sculley preferred creating computers using Open architecture, but Steve wanted to use closed architecture. At the time, Steve Jobs was the company’s Board Chairman and had much power to influence everything. The growing rift between the two affected the company.

When Macintosh failed to outrival IBM PC, John Sculley used it as an opportunity to trim Steve’s powers in the company. John Sculley had gathered majority votes to demote Steve from being the board chairman, and he wanted him to head the “New Product Development.”

Steve Jobs and NeXT Computers

Steve devised a plan to get rid of John Sculley for his betrayal but failed. Eventually, Steve tabled in his resignation to the board and set up a new company called NeXT. The company started to make advanced computer workstations primarily for institutions. However, NeXT workstations were pricey, and the market didn’t embrace them well.

Later, Apple acquired NeXT for $429 million and 1.5 million shares of Apple stocks.

Joining Pixar and Walt Disney

In 1979, Lucasfilm, an American film and television company, had started a computer division called the Graphics Group. However, the division was turned into an independent corporation which was then named Pixar.

After the company had been founded, Lucasfilm started to look for investors, connecting them to Steve Jobs for funding. By then, Steve Jobs was already running his new company, NeXT. Still, he joined Pixar’s board as Chairman after giving them $5 million for technology rights and investing an additional $5 million cash as capital into the company.

By the late 1980s, computer animation technology was not advanced, and production costs were high. Thus, the company faced some challenges for a short while.

In 2006, Pixar was bought by Walt Disney for $7.4 billion, making Steve Jobs the biggest shareholder of the company. This also ultimately made him become a board member of Walt Disney. Currently, his family still holds shares in Walt Disney, which owns Pixar Animation Studios.

-

Spzrts5 years ago

Spzrts5 years agoWhat’s the Hype Around FlightReacts?

-

World5 years ago

World5 years agoArtificial Intelligence in the Modern World

-

Genfluencer5 years ago

Genfluencer5 years agoHow StevoLuddy Uses TikTok to Further Pursue His Passion

-

Genfluencer5 years ago

Genfluencer5 years agoHow Rowan Winch Makes Thousands From His Phone

-

Digital Culture5 years ago

Digital Culture5 years agoThe Effects of Social Media on the iGen (Generation Z)

-

Spzrts5 years ago

Spzrts5 years agoHow the “Basketball Bubble” Runs on Technology

-

Digital Culture5 years ago

Digital Culture5 years agoHow to Navigate TikTok with Adam Meskouri

-

Digital Culture4 years ago

Digital Culture4 years agoWhy YouTuber Niko Omilana Is Running For Mayor